Lower Fed Rate Means Opportunities on the Rise

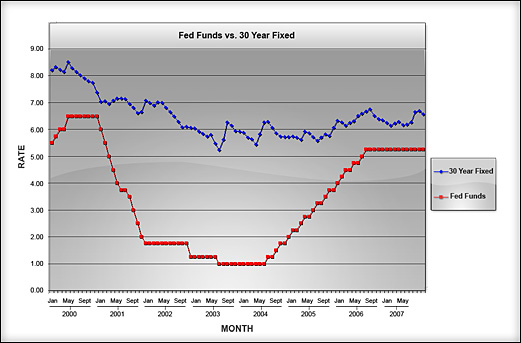

For the first time in more than four years, the Federal Reserve cut its Fed Funds Rate, which directly impacts millions of American borrowers. And while this important decision has many implications, there’s still some debate among experts about what this means to the economy as a whole. The Federal Reserve meets again in six weeks, and no one is certain how market volatility and inflation concerns will affect their future policy and decision-making. Bottom line: Take advantage of this opportunity while you still can.- If you’re looking to capture a lower interest rate for refinancing or buying a home, this could be your best opportunity to do so.

- If you have an Adjustable Rate Mortgage, while this rate cut might help to improve your situation, now is the time to refinance into a fixed-rate loan.

- If you have a Home Equity Line of Credit (HELOC) or credit cards tied to the Prime Rate, the Fed’s cut in the Fed Funds Rate just put a little money in your pocket.